UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | | | | |

| Filed by the Registrant | ☒ | | Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| | | | | | | | |

☒☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a6(e)(2)) |

| |

☐☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to §240.14a12 |

ELASTIC N.V.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

800 West El Camino Real, Suite 350

Mountain View, California 94040

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

| | | | | | | | |

Meeting Details | | |

Time:Date and Time | Place | Record Date |

Thursday, October 5, 2023 5:00 PM, Central European Summer Time |

Date: | Thursday, October 6, 2022 |

Address: | Keizersgracht 281, 1016 ED Amsterdam, the Netherlands | September 7, 2023 |

To the Shareholders of Elastic N.V.:

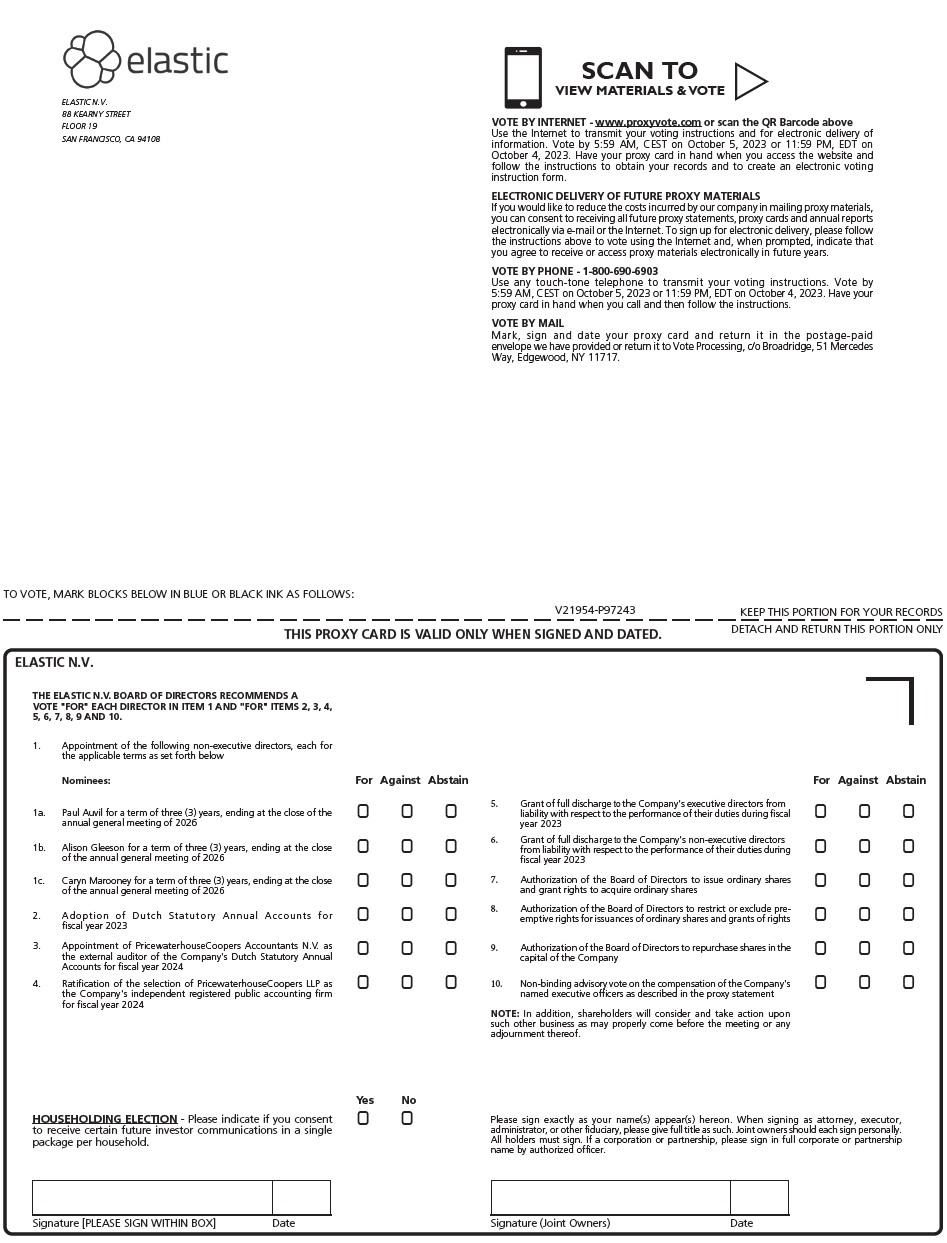

Notice is hereby given that an Annual General Meeting of Shareholders (the “Annual Meeting”) of Elastic N.V., a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands (the “Company,” “Elastic,” or “we”), will be held on October 6, 20225, 2023, at 5:00 PM, Central European Summer Time (“CEST”), at the Company’s offices at Keizersgracht 281, 1016 ED Amsterdam, the Netherlands. At the Annual Meeting, weshareholders will discussconsider the following items of business:

| | | | | |

| Item 1 | Opening and announcements |

| Item 2 | Overview of the Company’s business, financial situation and sustainability |

| Item 3 | Appointment of Sohaib Abbasi,Paul Auvil, Alison Gleeson, and Caryn Marooney Chetan Puttagunta, and Steven Schuurman as non-executive directors (voting proposal no. 1) |

| Item 4 | Financial statements and results

a.Discussion of the Company’s financial statements for the fiscal year that commenced on May 1, 20212022 and ended on April 30, 20222023 (“fiscal year 2022”2023”), including the Dutch statutory board report and annual accounts

b.Proposal to adopt the Dutch statutory financial statements prepared in accordance with International Financial Reporting Standardsannual accounts of the Company for fiscal year 20222023 (voting proposal no. 2) |

| Item 5 | Proposal to appoint PricewaterhouseCoopers Accountants N.V. as the Company’s external auditor of the Company’s Dutch statutory annual accounts for the fiscal year ending April 30, 20232024 (voting proposal no. 3) |

| Item 6 | Ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 20232024 (voting proposal no. 4) |

| Item 7 | Proposal to grant full discharge to the executive directors of the Company who were in office during fiscal year 20222023 from liability for their duties performed as executive directors of the Company during fiscal year 20222023 (voting proposal no. 5) |

| Item 8 | Proposal to grant full discharge to the non-executive directors of the Company who were in office during fiscal year 20222023 from liability for their duties performed as non-executive directors of the Company during fiscal year 20222023 (voting proposal no. 6) |

| Item 9 | Authorization of the board of directors to issue ordinary shares and grant rights to acquire ordinary shares (voting proposal no. 7) |

| Item 10 | Authorization of the board of directors to restrict or exclude pre-emptive rights for issuances of ordinary shares and grants of rights (voting proposal no. 8) |

| Item 11 | Authorization of the board of directors to repurchase ordinary shares (voting proposal no. 79) |

Item 1012 | Approval of the Elastic N.V. 2022 Employee Stock Purchase Plan (voting proposal no. 8)

|

Item 11 | Proposal to approve, on a non-binding advisory basis, the compensation of our named executive officers as described in this proxy statement (voting proposal no. 910) |

Item 1213 | Any other business |

Item 1314 | Closing of the meeting |

Each person authorized to attend the Annual Meeting may inspect the agenda of the Annual Meeting and the financial statements, including the Dutch statutory boardannual report, and annual accounts, at the Company’s offices in the United States at 800 West El Camino Real, Suite 350 Mountain View, California 94040 and at our officesoffice in the Netherlands at Keizersgracht 281, 1016 ED Amsterdam.

The Board of Directors unanimously recommends that you vote “FOR” each director nominee named in voting proposal no. 1 and “FOR” each of the remaining voting proposals as noted above.

The Record Daterecord date for the Annual Meeting (the “Record Date”) is at the close of business at 5:00 PM, Eastern Daylight Time (“EDT”) (11:00 PM, Central European Summer Time) on September 8, 20227, 2023 and, therefore, only the Company’s shareholders of record at the close of business on September 8, 2022that time are entitled to receive this notice (the “Notice”) and to vote at the Annual Meeting.

If you intend to attend the Annual Meeting in person, you must notify the Company by submitting your name and the number of registered shares you hold to the Company’s e-mail address ir@elastic.co by 8:00 PM, EDT on October 3, 2022.2, 2023. Please read this proxy statement carefully to ensure that you have proper evidence of share ownership as of September 8, 2022,7, 2023, as we will not be able to accommodate guests without such evidence at the Annual Meeting.

We provide our materials pursuant to the full set delivery option in connection with the Annual Meeting. Under the full set delivery option, a company delivers all proxy materials to its shareholders. The approximate date on which the proxy statement and proxy card are intended to be first sent or given to the Company’s shareholders is .September 12, 2023. This delivery can be by mail or, if a shareholder has previously agreed, by e-mail. In addition to delivering proxy materials to shareholders, the Company must also post all proxy materials on a publicly accessible website and provide information to shareholders about how to access that website. Accordingly, you should have receivedreceive our proxy materials by mail or, if you previously agreed, by e-mail. These proxy materials include this Notice of Annual General Meeting of Shareholders, this proxy statement, and the proxy card. These materials are available free of charge on our website at ir.elastic.co and at www.proxyvote.com.

Your vote is important regardless of the number of Elastic ordinary shares that you own. If you do not plan on attendingto attend the Annual Meeting and if you are a shareholder of record, please votesubmit your proxy instructions via the Internet or, if you are a holder of shares in street name (“Beneficial Owner”(a “beneficial owner”), please submit the voting instruction form you receive from your broker or nominee as soon as possible so your shares can be voted at the Annual Meeting. You may submit your voting instruction form by mail. If you are a shareholder of record, you also may voteprovide your proxy instructions by telephone or by submitting a proxy card by mail. If you are a Beneficial Owner,beneficial owner, you will receive instructions from your broker or other nominee explaining how to vote your shares, and you also may have the choice of instructinginstruct the record holder as to the voting ofvote your shares over the Internet or by telephone. Followshares. You should follow the instructions on the voting instruction form you receive from your broker or nominee. You do not need to affix postage to the enclosed reply envelope if you mail it within the United States. If you attend the Annual Meeting, you may withdraw your proxy and vote your shares personally.

All proxies submitted to us will be tabulated by Broadridge Financial Solutions, Inc. All shares voted by shareholders of record present in person at the Annual Meeting will be tabulated by the secretary designated by the chairperson of the Annual Meeting.

All shareholders are extended an invitation to attend the Annual Meeting.

If you have any questions concerning this proxy statement, would like additional copies of this proxy statement or need help voting your shares of Elastic ordinary shares, please contact our Investor Relations department at ir@elastic.co.

Thank you for your ongoing support of Elastic.

By the order of the Board of Directors of Elastic N.V.

Carolyn Herzog

Chief Legal Officer and Corporate Secretary

Mountain View, California

The date of this proxy statement is , and it is being mailed to shareholders on or about .August 28, 2023.

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION, DATED AUGUST 16, 2022

ELASTIC N.V.

800 West El Camino Real, Suite 350

Mountain View, California 94040

PROXY STATEMENT FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 6, 20225, 2023

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND PROCEDURAL MATTERSProxy Statement Voting Proposals Summary

The information provided in the “question and answer” format below is for your convenience only and is merely aThis proxy statement voting summary of thehighlights information contained elsewhere in this proxy statement. YouThis summary does not contain all of the information you should consider, so please read thisthe entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intendedcarefully before voting.

Items of Business

The following table summarizes the proposals to be incorporated by reference into this proxy statementvoted upon at the annual general meeting of shareholders of Elastic N.V. (the “Company,” “Elastic,” “we,” “us” or “our”) to be held on October 5, 2023 (the “Annual Meeting”) and referencesthe Board’s voting recommendations with respect to our website address in this proxy statement are inactive textual references only.each proposal.

| | | | | |

Q: | Why am I receiving these proxy materials? |

A: | You are receiving these proxy materials because you were a shareholder of record or beneficial owner of the ordinary shares of Elastic N.V. (the “Company,” “Elastic,” “we,” “us” or “our”) as of the close of business at 5:00 PM Eastern Daylight Time (“EDT”) on September 8, 2022 (the “Record Date”) for an annual general meeting of shareholders of Elastic to be held on October 6, 2022 (the “Annual Meeting”). We do this in order to solicit voting proxies for use at the Annual Meeting. If you are a shareholder of record and you submit your proxy to us, you direct a civil law notary of Zuidbroek Corporate Law Notaries and their legal substitutes to vote your shares in accordance with the voting instructions in your proxy. If you are a beneficial owner and you follow the voting instructions provided in the notice you receive from your broker, bank or other intermediary, you direct such organization to vote your shares in accordance with your instructions. These proxy materials are being distributed to you on or about . As a shareholder, you are invited to attend the Annual Meeting, and we request that you vote on the proposals described in this proxy statement. |

| Please refer to the question entitled “What is the difference between holding shares as a shareholder of record or as a beneficial owner?” below for important details regarding different forms of share ownership. |

| The enclosed voting materials allow you to vote your shares without attending the Annual Meeting. Your vote is important. We encourage you to vote as soon as possible. These proxy materials are being made available or distributed to you on or about .

|

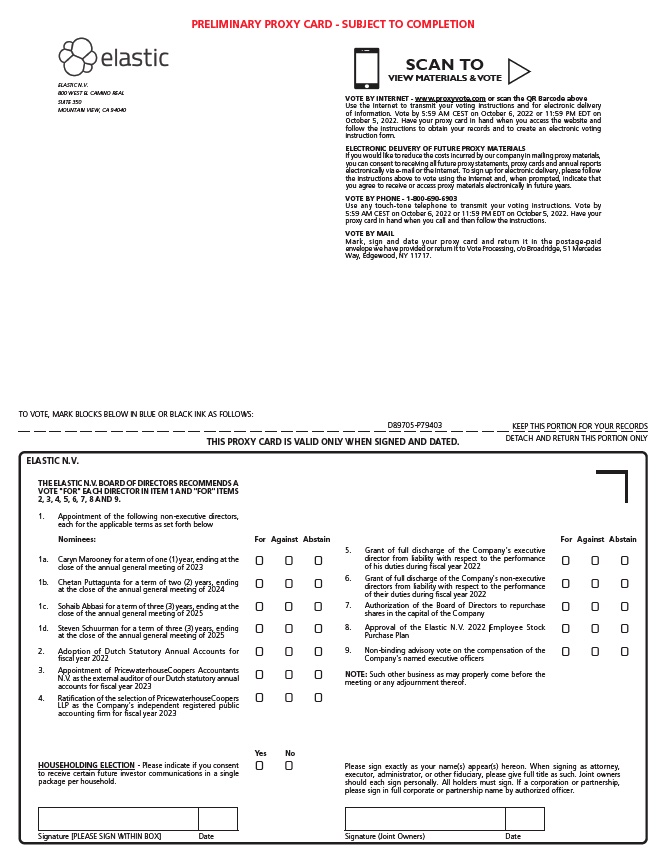

Q: | What proposals will be voted on at the Annual Meeting? |

A: | Shareholders will be asked to adopt voting proposals no. 1, no. 2, no. 3, no. 4, no. 5, no. 6, no. 7, no. 8 and no. 9 as described in this proxy statement. |

Q: | How does the board of directors recommend that I vote? |

A: | After careful consideration, the board of directors unanimously recommends that the Company’s shareholders vote: |

| •“FOR” the appointment of the nominees as non-executive directors of the Company (“voting proposal no. 1”);

|

| •“FOR” the adoption of the Company’s Dutch statutory annual accounts (the “Dutch Statutory Annual Accounts”) (“voting proposal no. 2”);

|

| •“FOR” the appointment of PricewaterhouseCoopers Accountants N.V. as the Company’s external auditor of the Company’s Dutch statutory annual accounts for the fiscal year ending April 30, 2023 (“voting proposal no. 3”);

|

| •“FOR” the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accountant for the fiscal year ending April 30, 2023 (“voting proposal no. 4”);

|

| •“FOR” the granting of full discharge to the executive directors of the Company who were in office during fiscal year 2022 (“voting proposal no. 5”);

|

| •“FOR” the granting of full discharge to the non-executive directors of the Company who were in office during fiscal year 2022 (“voting proposal no. 6”);

|

| | | | | | | | | | | |

| Voting Proposals | Board

Recommendation | Page

Reference |

| 1 | Board Appointments | FOR

each nominee | |

| 2 | Adoption of Company’s Dutch statutory annual accounts (the “Dutch Statutory Annual Accounts”) for fiscal year 2023 | FOR | |

| 3 | Appointment of PricewaterhouseCoopers Accountants N.V. as external auditor of the Company’s Dutch Statutory Annual Accounts for fiscal year 2024 | FOR | |

| 4 | Ratification of selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2024 | FOR | |

| 5 | Grant of full discharge to executive directors | FOR | |

| 6 | Grant of full discharge to non-executive directors | FOR | |

| 7 | Authorization of board of directors to issue ordinary shares and grant rights to acquire ordinary shares under Dutch law | FOR | |

| 8 | Authorization of board of directors to restrict or exclude pre-emptive rights for issuances of ordinary shares and grants of rights | FOR | |

| 9 | Authorization of board of directors to repurchase shares in the capital of the Company | FOR | |

| 10 | Non-binding advisory vote to approve compensation of named executive officers as described in this proxy statement | FOR | |

Proxy Statement Voting Proposals Summary | Elastic 2023 Proxy Statement1

| | | | | |

| •“FOR” the approval to authorize the board of directors to repurchase shares in the capital of the Company (“voting proposal no. 7”);

|

| •“FOR” the approval of the Elastic N.V. 2022 Employee Stock Purchase Plan (“voting proposal no. 8”); and

|

| •“FOR” the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers (as defined below) (“voting proposal no. 9”).

|

Q: | Can I attend the Annual Meeting? |

A: | You may attend the Annual Meeting if, on the Record Date, you were a shareholder of record or a beneficial owner. If you would like to attend the Annual Meeting in person, you must notify the Company by submitting your name and number of registered shares to the Company’s e-mail address ir@elastic.co by 8:00 PM EDT on October 3, 2022. You will be asked to show photo identification and the following: |

| •If you are a shareholder of record, your paper proxy card that includes your name, or admission ticket that you received with a paper proxy card or that you obtained from our shareholder voting site at www.proxyvote.com; or

|

| •If you are a beneficial owner, the voting instruction card you received from your broker, bank or other intermediary, or a printed statement from such organization or online access to your brokerage or other account, showing your share ownership on the Record Date.

|

| We will not be able to accommodate guests without proper evidence of share ownership as of the Record Date at the Annual Meeting, including guests of our shareholders. |

| The Annual Meeting will begin promptly at 5:00 PM Central European Summer Time (“CEST”), and you should leave ample time for the check-in procedures. |

Q: | Where is the Annual Meeting? |

A: | The Annual Meeting will be held at the Company’s offices at Keizersgracht 281, 1016 ED Amsterdam, the Netherlands. Shareholders may request directions to the Annual Meeting by contacting Investor Relations at 800 West El Camino Real, Suite 350, Mountain View, California 94040, e-mail ir@elastic.co. |

Q: | Who is entitled to vote at the Annual Meeting? |

A: | You may vote your shares of Elastic ordinary shares if you owned your shares at the close of business on the Record Date. You may cast one vote for each ordinary share held by you as of the Record Date on all matters presented. As of (the last practicable date prior to the Record Date and the mailing of the proxy statement), we had ordinary shares issued and outstanding. See the questions entitled “How can I vote my shares in person at the Annual Meeting?” and “How can I vote my shares without attending the Annual Meeting?” below for additional details.

|

Q: | What is the difference between holding shares as a shareholder of record or as a beneficial owner? |

A: | You are the “shareholder of record” of any shares that are registered directly in your name with Elastic’s transfer agent, Computershare Trust Company, N.A. We have sent the proxy statement and proxy card directly to you if you are a shareholder of record. As a shareholder of record, you may grant your voting proxy directly to Elastic or to a third party, or vote in person at the Annual Meeting. If you are a shareholder of record and you submit your proxy to us, you direct a civil law notary of Zuidbroek Corporate Law Notaries and their legal substitutes to vote your shares in accordance with the voting instructions in your proxy. |

| | | | | |

| You are the “beneficial owner” of any shares (which are considered to be held in “street name”) that are held on your behalf in a brokerage account or by a bank or another intermediary that is the shareholder of record for those shares. If you are a beneficial owner, you did not receive proxy materials directly from Elastic, but your broker, bank or other intermediary forwarded you a proxy statement and voting instruction card for directing that organization how to vote your shares. You may also attend the Annual Meeting, but because a beneficial owner is not a shareholder of record, you may not vote in person at the Annual Meeting unless you obtain a “legal proxy” from the organization that holds your shares, giving you the right to vote the shares at the Annual Meeting.

|

Q: | How can I vote my shares in person at the Annual Meeting? |

A: | You may vote shares for which you are the shareholder of record in person at the Annual Meeting. You may vote shares you hold beneficially in street name in person at the Annual Meeting only if you obtain a “legal proxy” from the broker, bank or other intermediary that holds your shares, giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also direct the voting of your shares as described below in the question entitled “How can I vote my shares without attending the Annual Meeting?” so that your vote will be counted even if you later decide not to attend the Annual Meeting.

|

Q: | How can I vote my shares without attending the Annual Meeting? |

A: | Whether you hold shares as a shareholder of record or a beneficial owner, you may direct how your shares are voted without attending the Annual Meeting, by the following means: |

| By Internet—Shareholders of record with Internet access may direct how their shares are voted by following the “Vote by Internet” instructions on the proxy card until 5:59 a.m. CEST on October 6, 2022/11:59 p.m. EDT on October 5, 2022. If you are a beneficial owner of shares held in street name, please check the voting instructions in the voting instruction card provided by your broker, bank or other intermediary for Internet voting availability.

|

| By telephone—Shareholders of record who live in the United States or Canada may submit proxies by telephone by following the “Vote by Telephone” instructions on the proxy card until 5:59 a.m. CEST on October 6, 2022/11:59 p.m. EDT on October 5, 2022. If you are a beneficial owner of shares held in street name, please check the voting instructions in the voting instruction card provided by your broker, bank or other intermediary for telephone voting availability.

|

| By mail—If you elect to vote by mail, please complete, sign and date the proxy card where indicated and return it in the prepaid envelope included with the proxy card. Proxy cards submitted by mail must be received by the time of the Annual Meeting in order for your shares to be voted. If you are a beneficial owner of shares held in street name, you may vote by mail by following the instructions for voting by mail in the voting instruction card provided by your broker, bank or other intermediary.

|

Q: | How many shares must be present or represented to conduct business at the Annual Meeting? |

A: | The shareholders of record of at least one third of the shares entitled to vote at the Annual Meeting must either (1) be present in person at the Annual Meeting or (2) have properly submitted a proxy in order to constitute a quorum at the Annual Meeting. |

Q: | What is the voting requirement to approve the proposals? |

A: | The nominees mentioned under voting proposal no. 1 will be appointed to the board of directors unless a two-thirds majority of the votes cast at the Annual Meeting, which votes must represent more than one-half of the issued and outstanding share capital, are cast against the proposal. |

| Each of voting proposals no. 2, no. 3, no. 4, no. 5, no. 6 no. 7, no. 8 and no. 9 requires a simple majority of votes cast in an Annual Meeting where at least one-third of the issued and outstanding ordinary shares of the Company are represented. Proposal no. 9, commonly referred to as the “say-on-pay” vote, is advisory and not binding. Our board of directors will review the voting results and take them into consideration in determining the compensation of our Named Executive Officers. |

| | | | | |

Q: | What will happen if I fail to vote or vote to abstain from voting? |

A: | If you are the shareholder of record and you fail to vote or abstain from voting, it will have no effect on the voting proposals, assuming a quorum is present. If you are a beneficial owner and you fail to provide the organization that is the shareholder of record for your shares with voting instructions, the organization will not have discretion to vote on the non-routine matters that will be proposed at the Annual Meeting. If you fail to provide voting instructions to the organization or instruct the organization to vote your shares to abstain from voting, it will have no effect on the voting proposals. If you are a beneficial owner and you fail to provide the organization that is the shareholder of record for your shares with voting instructions, the organization will have discretion to vote on the routine matters that will be proposed at the Annual Meeting. |

Q: | What will happen if I submit a proxy but do not specify how my shares are to be voted? |

A: | If you are the shareholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted as recommended by the board of directors. |

| If you are a beneficial owner and you do not provide the organization that is the shareholder of record for your shares with voting instructions, the organization will not have discretion to vote on non-routine matters, such as voting proposals nos. 1, 2, 5, 6, 7, 8 and 9. |

Q: | What is the effect of a broker non-vote? |

A: | A broker non-vote occurs when a broker, bank or other intermediary that is otherwise counted as present or represented by proxy does not receive voting instructions from the beneficial owner and does not have the discretion to vote the shares. A broker present or represented by proxy will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, and a broker non-vote will be treated as an abstention and therefore not be counted for purposes of determining the number of votes cast with respect to a particular proposal as to which that broker non-vote occurs. Thus, a broker non-vote will not impact our ability to obtain a quorum for the Annual Meeting and will not otherwise affect the outcome of the non-routine matters properly presented for a vote at the Annual Meeting. |

Q: | Can I change my vote? |

A: | If you are the shareholder of record, you may change your vote (1) by submitting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the voting methods described above in the question entitled “How can I vote my shares without attending the Annual Meeting?,” (2) by providing a written notice of revocation to Elastic’s Corporate Secretary at Elastic N.V., 800 West El Camino Real, Suite 350, Mountain View, California 94040, prior to your shares being voted, or (3) by attending the Annual Meeting and voting in person, which will supersede any proxy previously submitted by you. However, merely attending the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically request it.

|

| If you are a beneficial owner of shares held in street name, you may generally change your vote by (1) submitting new voting instructions to your broker, bank or other intermediary or (2) if you have obtained a legal proxy from the organization that holds your shares giving you the right to vote your shares, by attending the Annual Meeting and voting in person. However, please consult that organization for any specific rules it may have regarding your ability to change your voting instructions. |

| | | | | |

Q: | What should I do if I receive more than one proxy card, voting instruction card from my broker, bank or other intermediary, or set of proxy materials? |

A: | You may receive more than one proxy card, voting instruction card from your broker, bank or other intermediary or set of proxy materials. For example, if you are a beneficial owner with shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card or voting instruction card that you receive, or follow the voting instructions on such proxy card or voting instruction card you receive, to ensure that all your shares are voted. |

Q: | Is my vote confidential? |

A: | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Elastic or to third parties, except: (1) as necessary for applicable legal requirements, (2) to allow for the tabulation and certification of the votes, and (3) to facilitate a successful proxy solicitation or a shareholder outreach. Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to Elastic management. |

Q: | Who will serve as inspector of election? |

A: | The inspector of election will be Broadridge Financial Solutions, Inc. |

Q: | Where can I find the voting results of the Annual Meeting? |

A: | We will publish final voting results in our Current Report on Form 8-K, which will be filed with the U.S. Securities and Exchange Commission (“SEC”) and made available on its website at www.sec.gov within four business days of the Annual Meeting. |

Q: | Who will bear the cost of soliciting votes for the Annual Meeting? |

A: | Elastic will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. In addition to the use of the mail, proxies may be solicited by officers and directors and regular employees of Elastic, some of whom may be considered participants in the solicitation, without additional remuneration, by personal interview, telephone, facsimile or otherwise. Elastic may also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record on the Record Date and will provide customary reimbursement to such firms for the cost of forwarding these materials. |

| | | | | |

Q: | What is the deadline to propose actions for consideration at next year’s annual general meeting or to nominate individuals to serve as directors? |

A: | Future Shareholder Proposals for inclusion in the Company’s proxy materials under SEC rules

Any shareholder desiring to present a resolution for inclusion in the Company’s proxy statement for the annual general meeting of shareholders to be held in 2023 (the “2023 Annual Meeting”) must deliver such resolution to the Company’s Corporate Secretary at the address below no later than , 2023 (120 days before the anniversary date of the release of this proxy statement to shareholders). Only those resolutions that comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be included in the Company’s proxy statement for the 2023 Annual Meeting.

Future Shareholder Proposals to be brought at the annual general meeting under Dutch law

In addition, under Dutch law, shareholders are permitted to submit a resolution for consideration at the 2023 Annual Meeting so long as (1) such matter is received by the Company no later than 60 days prior to the date of the meeting, and (2) the shareholder or group of shareholders submitting the proposed agenda item or resolutions owns at least 3% of the Company’s issued share capital.

Complete details regarding all requirements that must be met regarding advance notice procedure for shareholders who wish to present certain matters at an annual general meeting of shareholders can be found in our articles of association. See “Future Shareholder Proposals.”

All submissions to the Company should be made to:

Elastic N.V.

800 West El Camino Real, Suite 350

Mountain View, California 94040

Attention: Investor Relations

Email: ir@elastic.co

Shareholders may recommend director candidates for consideration by our nominating and corporate governance committee. For additional information regarding our policy regarding shareholder recommendations for director candidates, see “Board of Directors and Corporate Governance—Policies Governing Director Nominations—Director Nomination Process.”

|

Q: | What is householding and how does it affect me? |

A: | The SEC permits companies that provide advance notice and follow certain procedures to send a single set of proxy materials to any household at which two or more shareholders of record reside, unless contrary instructions have been received. In such cases, each shareholder of record continues to receive a separate set of proxy materials. Certain brokerage firms may have instituted householding for beneficial owners. If your family has multiple accounts holding Elastic ordinary shares, you may have already received householding notification from your broker. Please contact your broker directly if you have any questions or require additional copies of this proxy statement. The broker will arrange for delivery of a separate copy of this proxy statement promptly upon your written or oral request. You may decide at any time to revoke your decision to household, and thereby receive multiple copies. |

Q: | Who can help answer my questions? |

A: | Please contact our Investor Relations Department by writing to Elastic N.V., 800 West El Camino Real, Suite 350, Mountain View, California 94040, Attention: Investor Relations or e-mail ir@elastic.co. If you have questions about the proposals or the information contained in this proxy statement, or desire additional copies of this proxy statement, or if you are a shareholder of record, additional proxy cards, please contact our Investor Relations Department. |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board of Directors

The board of directors of the Company is responsible for establishing broad corporate policies and monitoring the overall performance of the Company. The board of directors selects the Company’s senior management, delegates authority for the conduct of the Company’s day-to-day operations to those senior managers,management, and monitors their performance. Members of the board of directors are kept informed of the Company’s business by, among other things, participating in meetings of the board of directors and committees and by reviewing analyses and reports provided to them.

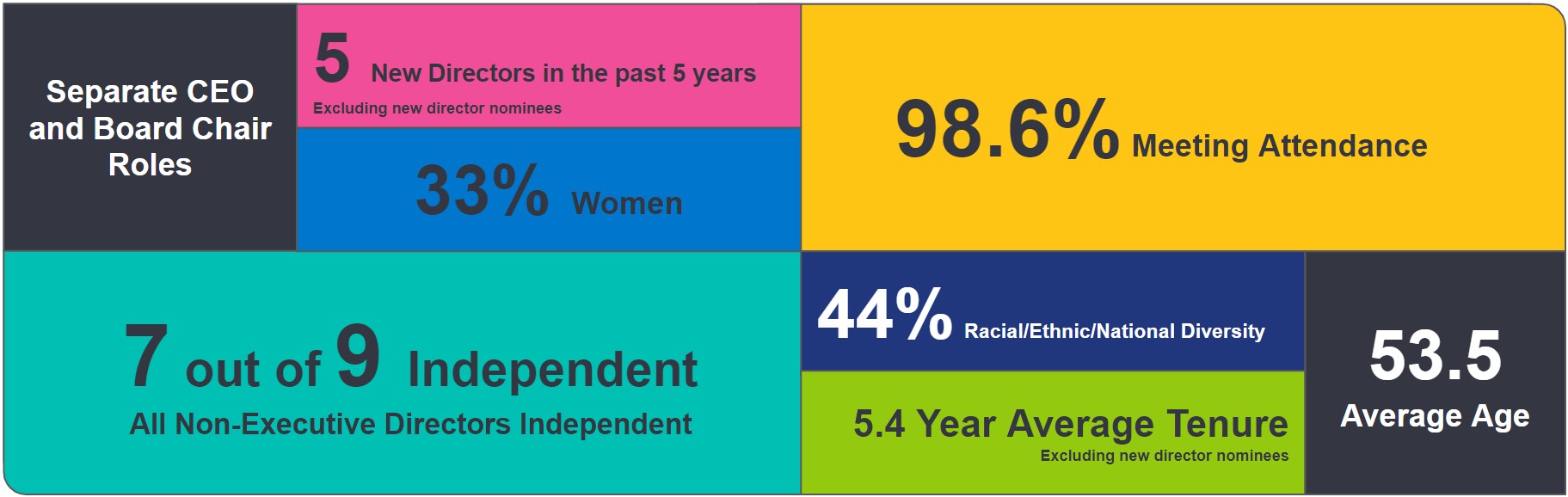

The board of directors is currently made up of nine directors. We have a one-tier board of directors, consisting of executive and non-executive directors. The board of directors determines the number of executive and non-executive directors.

The board of directors is currently composed of nine directors. We have two executive directors, our Chief Executive Officer and our Chief Technology Officer, and seven non-executive directors.

We have a classified board of directors in which directors serve for staggered terms. Under the Company’s articles of association, all directorseach director may hold officebe appointed for a maximum term of three years, provided that suchthe director’s term shall ultimatelywill lapse immediately after the close of the first annual general meeting held after three years (or less if the term is shorter than three years) have lapsed since the director’s appointment, or until theirthe director’s earlier death, resignation or removal. A director may be reappointed, and the three-year maximum term may be deviated from by resolution of the general meeting of shareholders upon a proposal of the board of directors.

In the five years since our initial public offering, our Nominating and Corporate Governance Committee and board of directors has focused on developing and maintaining a board composed of directors who possess the qualifications and experience to effectively implement our business strategy and reflect our corporate culture. When we became a public company in 2018, half of our board of directors consisted of members affiliated with the venture capital firms that had financed our growth as a private company, and all of our directors were men. Since that time, two representatives of the venture capital firms have transitioned off our board of directors, which has also become more diverse and has grown from six to nine members, with three women. The evolution of our board of directors has been facilitated by our board structure, which has enabled directors appointed each year to build on their own experience and the experience of our continuing directors for more effective long-term strategic planning and oversight.

As discussed under “Board Appointments — Voting Proposal 1,” Mr. Chadwick chose not to stand for re-appointment to the board of directors at the Annual Meeting. Mr. Chadwick has served on our board of directors since August 2018, and we are grateful for his dedication and contributions to our company during this period.

The following table sets forth the names, ages as of July 31, 2022,August 21, 2023, and certain other information for each of the directors who are nominees for appointment as a director at the Annual Meeting and for each of the continuing members of our board of directors:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Current Term Expires | Expiration of Term For Which Nominated | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Nominees for Director | | | | | | | | |

Sohaib Abbasi Vice-Chairman | 66 | 2022 | * | 2025 | Yes | | ü | |

| Caryn Marooney | 55 | 2019 | 2022 | 2023 | Yes | | | ü |

Chetan Puttagunta Chairman Lead Independent Director | 36 | 2017 | 2022 | 2024 | Yes | ü | | © |

| Steven Schuurman | 46 | 2012 | 2022 | 2025 | Yes | | | |

| Continuing Directors | | | | | | | | |

Ashutosh Kulkarni Executive Director Chief Executive Officer (“CEO”) | 47 | 2022 | 2025 | - | No | | | |

Shay Banon Executive Director Chief Technology Officer (“CTO”) | 44 | 2012 | 2024 | - | No | | | |

| Jonathan Chadwick | 56 | 2018 | 2023 | - | Yes | © | ü | |

| Alison Gleeson | 57 | 2020 | 2023 | - | Yes | | © | |

| Shelley Leibowitz | 61 | 2021 | 2024 | - | Yes | ü | | ü |

Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 2

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Current Term Expires | Expiration of Term For Which Nominated | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Nominees for Director | | | | | | | | |

Paul Auvil(1) | 59 | - | - | 2026 | Yes | ©(1) | ü(1) | |

| Alison Gleeson | 58 | 2020 | 2023 | 2026 | Yes | | © | |

| Caryn Marooney | 56 | 2019 | 2023 | 2026 | Yes | | | ü |

| Continuing Directors | | | | | | | | |

Ashutosh Kulkarni Executive Director Chief Executive Officer (“CEO”) | 48 | 2022 | 2025 | - | No | | | |

Shay Banon Executive Director Chief Technology Officer (“CTO”) | 45 | 2012 | 2024 | - | No | | | |

Chetan Puttagunta Chairperson Lead Independent Director | 37 | 2017 | 2024 | - | Yes | ü | | © |

Sohaib Abbasi Vice-Chairperson | 67 | 2022 | 2025 | - | Yes | | ü | |

| Shelley Leibowitz | 62 | 2021 | 2024 | - | Yes | ü | | ü |

| Steven Schuurman | 47 | 2012 | 2025 | - | Yes | | | |

| | | | | | | | |

© | = | ChairpersonCommittee Chair |

*On July 7, 2022,(1) If Mr. Auvil is appointed to our board of directors at the Annual Meeting, he will serve as the Chair of our audit committee and as a member of our compensation committee.

Board Diversity

We believe that our board of directors should reflect a diversity of perspectives and backgrounds. We have had a formal diversity policy since our initial public offering. When assessing the background, qualifications and experience of a candidate for our board of directors, the board of directors appointed Mr. Abbasitakes into account a broad range of factors, including such diversity attributes as the candidate’s gender, race, ethnicity, education, professional background, and international experience among others. The table below presents certain self-identified characteristics of our director nominees and continuing directors.

Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 3

| | | | | | | | | | | | | | |

| Board Diversity Matrix |

| Total Number of Directors: 9 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors | 3 | 6 | - | - |

| Number of Directors Who Identify as: |

| African American or Black | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | 3 | - | - |

| Hispanic or Latinx | - | - | - | - |

| Middle Eastern | - | 1 | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White (not of Hispanic or Latinx origin) | 3 | 2 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 4

Board Skills and Experience Matrix

Our board of directors has taken a thoughtful approach to replace Michelangelo Volpi as a non-executive director, Vice-Chairmanboard composition to ensure that our directors have backgrounds that collectively add value to the strategic decisions made by the Company and that enable them to provide oversight of management to ensure accountability to our shareholders. The matrix below summarizes some of the most relevant types of experience, qualifications, attributes and skills, which the board of directors believes should be possessed by our directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Abbasi | Auvil | Banon | Gleeson | Kulkarni | Leibowitz | Marooney | Puttagunta | Schuurman |

| Industry and IT/Technical Expertise Expertise in the technology industry to oversee our business and address the opportunities and risks we face | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Scaling a Cloud Business Experience growing a successful Cloud business, reaching multi-billion dollar scale and maturity | ü | ü | ü | ü | ü | ü | | ü | |

| CEO Experience Experience as CEO of a publicly traded company | ü | | ü | | ü | | | | |

| Modern Cloud Technology Expertise Deep knowledge in technology architecture for cloud-based platforms, integrated solutions and customers’ data journey | ü | | ü | | ü | | | ü | |

| Financial Knowledge and Expertise Knowledge of financial markets, financing and accounting and financial reporting processes | ü | ü | | | | ü | | ü | |

| Diverse Backgrounds and Experiences, Including International Experience Diverse backgrounds and experiences that provide unique perspectives and enhance decision-making | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Cybersecurity / Information Security / Security Expertise to oversee cybersecurity, privacy, and information security management | ü | ü | ü | | ü | ü | | | |

| Sales, Marketing and Brand Management Experience Sales, marketing, and brand management experience to provide expertise and guidance to grow sales and enhance our brand | ü | | ü | ü | ü | | ü | | ü |

| Human Capital Management Experience attracting and retaining diverse top talent to oversee our people and compensation policies in our competitive environment | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Public Company Board Experience and Corporate Governance Experience to understand the dynamics and operation of a public company, and corporate governance requirements and compliance | ü | ü | ü | ü | ü | ü | ü | ü | |

Set forth below is biographical information, as of August 21, 2023, about the persons nominated for appointment at the Annual Meeting and member of the Company’s Compensation Committee, effective July 13, 2022. Pursuant to Dutch law,continuing directors, as well as the qualifications, experience and skills the board of directors has also nominated Mr. Abbasi to stand for appointment to the board of directors (voting proposal no. 1). Mr. Abbasi was appointed toconsidered in determining that each such person should serve until the earlier of (i) the vacancy created by Mr. Volpi’s resignation being filled, which will occur if Mr. Abbasi is appointed upon conclusion of the Annual Meeting in accordanceas a director.

7Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 5

with voting proposal no. 1, (ii) the board appointing another person to temporarily fill such vacancy or (iii) the vacancy has been cancelled.

Our directors self-identify as set forth in the table below:

| | | | | | | | | | | | | | |

| Board Diversity Matrix (as of July 31, 2022) |

| Total Number of Directors: | 9 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors | 3 | 6 | - | - |

| Number of Directors Who Identify as: |

| African American or Black | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | 3 | - | - |

| Hispanic or Latinx | - | - | - | - |

| Middle Eastern | - | 1 | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White (not of Hispanic or Latinx origin) | 3 | 2 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

The biographies below include information, as of July 31, 2022, regarding the specific and particular experience, education and qualifications of the nominees for director and the continuing directors.

Nominees for Director

| | | | | | | | | | | | | | | | | | | | |

| | Sohaib Abbasi (Vice-Chairman)Paul Auvil | |

| Background and Experience | |

| Sohaib Abbasi Paul Auvil was nominated for appointment to our board of directors and is standing for appointment at the Annual Meeting.

•From March 2007 to February 2023, Mr. Auvil served as the CFO of Proofpoint, Inc., an enterprise security company that provides software as a service and products for email security, data loss prevention, electronic discovery, and email archiving. •From September 2006 to March 2007, Mr. Auvil was an entrepreneur-in-residence with Benchmark Capital, a venture capital firm. Prior to that position, from 2002 to July 2006, he served as the CFO at VMware, Inc., a virtualization company (“VMware”). Previously, he served as the CFO for Vitria Technology, Inc., an eBusiness platform company, and held various executive positions at VLSI Technology, Inc., a semiconductor and circuit manufacturing company, including Vice President of the Internet and Secure Products Division. •Mr. Auvil previously served on the board of directors of 1Life Healthcare, Inc. (doing business as One Medical) from September 2019 to February 2023, when it was acquired by Amazon, Inc. From 2007 to 2017, Mr. Auvil served on the board of directors for Quantum Corporation, a data storage company. From 2009 to 2010, Mr. Auvil served on the board of directors of OpenTV Corp., a provider of interactive television software and services. From 2009 to 2017, Mr. Auvil was a member of the board of directors of Marin Software Incorporated, a cloud-based advertisement management platform company. | |

| |

| |

| |

Age: 59 | | |

IF APPOINTED:

Audit Committee (Chair)

Compensation Committee | | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Mr. Auvil holds a Bachelor of Engineering degree from Dartmouth College and a Master of Management degree from the J.L. Kellogg Graduate School of Management, Northwestern University. | | The board of directors believes that Mr. Auvil is qualified to serve as a member of our board of directors because of his prior experience as CFO of public technology companies and his current and prior executive and directorship experience for multiple large public and private technology companies. | |

| |

| |

| | | | | | |

| | | | | | |

Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 6

| | | | | | | | | | | | | | | | | | | | |

| | Alison Gleeson | |

| Background and Experience | |

| Alison Gleeson has served as a member of our board of directors since January 2020. She has served as a sales strategic advisor to Verkada Inc., a professional monitoring and video verification threat detection company, since August 2021, and as Special Advisor and Operating Committee Member at Brighton Park Capital, an investment firm, since October 2019. | |

| |

| |

| •From November 2018 to September 2019, Ms. Gleeson was a private investor. •From January 1996 to October 2018, Ms. Gleeson served in various roles with Cisco Systems, Inc., a provider of software-defined networking, cloud and security solutions (“Cisco”), most recently as Senior Vice President, Americas from July 2014 to October 2018. •Ms. Gleeson currently also serves on the boards of directors of 8x8, Inc., a cloud-based provider of voice over IP products, and ZoomInfo Technologies Inc., a comprehensive sales and marketing intelligence SaaS platform. | |

Age: 58 | | |

| Compensation Committee (Chair) | | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Ms. Gleeson holds a B.A. in Marketing from Michigan State University. | | The board of directors believes that Ms. Gleeson is qualified to serve as a member of our board of directors because of her prior executive and go-to-market experience for a large public company. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Caryn Marooney | |

| Background and Experience | |

| Caryn Marooney has served as a member of our board of directors since April 2019. She has served as a General Partner of Coatue Management, LLC, a technology-focused venture capital firm, since November 2019. | |

| |

| |

| •From May 2011 to May 2019, Ms. Marooney served in various roles at Meta Platforms, Inc. (formerly Facebook, Inc.), a social networking and technology company, most recently serving as Vice President, Global Communications from March 2012 to May 2019. •From June 1997 to March 2011, Ms. Marooney served in various roles, including President and CEO, with The OutCast Agency, a public relations firm. •Ms. Marooney served as a member of the board of directors of Zendesk, Inc., a software development company that provides a software-as-a-service customer service platform, from January 2014 to May 2020. •Ms. Marooney also serves on the boards of various private companies. | |

Age: 56 | | |

| Nominating and Corporate Governance Committee | | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Ms. Marooney holds a B.S. in Labor Relations from Cornell University. | | The board of directors believes that Ms. Marooney is qualified to serve as a member of our board of directors because of her prior executive experience and her experience advising technology companies. | |

| |

| |

| | | | | | |

| | | | | | |

Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 7

Continuing Directors

| | | | | | | | | | | | | | | | | | | | |

| | Ashutosh Kulkarni (Chief Executive Officer) | |

| Background and Experience | |

| Ashutosh Kulkarni has served as our CEO since January 2022 and was elected to our board of directors in March 2022. Mr. Kulkarni previously served as our Chief Product Officer (“CPO”) from January 2021 to January 2022. | |

| |

| |

| •Prior to joining us, Mr. Kulkarni served as Executive Vice President and Chief Product Officer, Enterprise Business Group, at McAfee Corp., a digital provider of cyber security services, from October 2018 until December 2020. •Prior to joining McAfee Corp., Mr. Kulkarni served as Senior Vice President and General Manager at Akamai Technologies, Inc., a content delivery network, cybersecurity, and cloud service company, in the Web Performance and Web Security division from August 2016 to October 2018 and in the Web Experience division from August 2015 to August 2016. •Prior to that service, Mr. Kulkarni held various senior leadership, product management, product marketing and engineering roles at Akamai Technologies, Informatica and Sun Microsystems. | |

Age: 48 | | |

| | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Mr. Kulkarni earned an M.S. in computer engineering from the University of Texas at Austin, an M.B.A. degree from the University of California, Berkeley and a B.E. in engineering from the University of Mumbai. | | The board of directors believes that Mr. Kulkarni is qualified to serve as a member of the Board because of the perspective he brings as our CEO, our former CPO, and his experience as an executive in the technology industry. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Shay Banon (Chief Technology Officer) | |

| Background and Experience | |

| Shay Banon co-founded our Company and has served as a member of our board of directors since July 2012 and as our CTO since January 2022. Mr. Banon served as our CEO from May 2017 to January 2022, and as our Chairperson and CEO from June 2018 to January 2022. He previously also served as our CTO from July 2012 to April 2017. Mr. Banon is the creator of our Elasticsearch product.

| |

| |

| |

| |

Age: 45 | | |

| | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Mr. Banon holds a B.Sc. in Computer Science from Technion, Israel Institute of Technology. | | The board of directors believes that Mr. Banon is qualified to serve as a member of our board of directors because of the perspective and experience he brings as our CTO, our prior CEO and co-founder and his experience as an executive in the technology industry. | |

| |

| |

| | | | | | |

| | | | | | |

Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 8

| | | | | | | | | | | | | | | | | | | | |

| | Sohaib Abbasi (Vice-Chairperson) | |

| Background and Experience | |

| Sohaib Abbasi has served as a member of our board of directors and as our Vice-Chairperson since July 2022. He has also served as a member of the Executive Council of Balderton Capital, a venture capital firm, since January 2018 and as a Senior Advisor of TPG Global LLC, a private equity firm, since July 2017. | |

| |

| |

| •From July 2004 to August 2015, heMr. Abbasi served as the Chief Executive Officer of Informatica Corporation, a data integration company, where he also served as the Chair and a member of the board of directors from March 2004 to December 2015. •Mr. Abbasi previously served in various executive roles at Oracle Corporation, a computer technology corporation, most recently as a member of Oracle's executive committee and as senior vice presidentSenior Vice President of the Oracle Tools and Oracle Education divisions. •He currently serves on the boardsboard of several private companiesdirectors of Udemy, Inc., an online global learning platform company and previously served as a director of McAfee Corp., a computer security software company, from November 2018 to March 2022, New Relic, Inc., an enterprise software company, from May 2016 to September 2019, Nutanix, Inc., a cloud computing company, from March 2020 to December 2020, and Red Hat, Inc., a provider of enterprise open sourceopen-source software solutions, from March 2011 to July 2019. •He also currently serves on the boards of directors of several private companies | |

| |

| |

| |

Age:6667 | | |

| Compensation Committee | | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Mr. Abbasi holds a B.S. and an M.S. in Computer Science from the University of Illinois at Urbana-Champaign. | | We believeThe board of directors believes that Mr. Abbasi is qualified to serve as a member of our board of directors because of his prior experience as CEO of a public technology company and his current and prior executive and directorship experience for multiple large public and private technology companies. | |

| |

| |

| | | | | | |

| | | | | | |

8Board of Directors and Corporate Governance | Elastic 2023 Proxy Statement 9

| | | | | | | | | | | | | | | | | | | | |

| | Caryn Marooney | |

| Background and Experience | |

| Caryn Marooney has served as a member of our board of directors since April 2019. She has served as a General Partner of Coatue Management, LLC, a global investment manager, since November 2019.

•From May 2011 to May 2019, she served in various roles at Meta Platforms, Inc. (formerly Facebook, Inc.), a social networking and technology company, most recently serving as Vice President, Global Communications from March 2012 to May 2019.

•From June 1997 to March 2011, Ms. Marooney served in various roles, including President and CEO, of The OutCast Agency, a public relations firm.

•Ms. Marooney served as a member of the board of directors of Zendesk, Inc., a software development company that provides a software-as-a-service customer service platform, from January 2014 to May 2020.

•Ms. Marooney also serves on the boards of various private companies.

| |

| |

| |

| |

Age: 55

| | |

Nominating and Corporate Governance Committee | | |

| |

| |

| | | | | | |

Education | | Qualifications | |

Ms. Marooney holds a B.S. in Labor Relations from Cornell University. | | We believe that Ms. Marooney is qualified to serve as a member of our board of directors because of her prior executive experience and her experience advising technology companies. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Chetan Puttagunta

(Chairman and Lead Independent Director) | |

| Background and Experience | |

| Chetan Puttagunta has served as a member of our board of directors since January 2017, as our Chairman since January 2022, and as our Lead Independent Director since June 2018. Mr. Puttagunta has served as General Partner of Benchmark Capital Partners since July 2018.

•From October 2016 until July 2018, Mr. Puttagunta served as a General Partner of New Enterprise Associates, a venture capital firm he joined in April 2011.

•Mr. Puttagunta also serves on the boards of various private companies.

| |

| |

| |

| |

Age: 36

| | |

Nominating and Corporate Governance Committee (Chair)

Audit Committee | | |

| |

| |

| | | | | | |

Education | | Qualifications | |

Mr. Puttagunta holds a B.S. in Electrical Engineering from Stanford University. | | We believe that Mr. Puttagunta is qualified to serve as a member of our board of directors because of his extensive experience in the venture capital industry and his knowledge of the technology industry. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Steven Schuurman | |

| Background and Experience | |

| Steven Schuurman co-founded our Company and has served as a member of our board of directors since July 2012 and previously served as our CEO from July 2012 to May 2017. Mr. Schuurman serves on the boards of various private companies.

| |

| |

| |

| |

Age: 46

| | |

| | |

| |

| | | | | | |

Education | | Qualifications | |

Mr. Schuurman holds a B.Sc. in Electrical Engineering from TH Rijswijk, now known as The Hague University of Applied Sciences. | | We believe Mr. Schuurman is qualified to serve as a member of our board of directors because of his deep understanding of our business, operations and strategy due to his role as our co-founder and former CEO. | |

| |

| |

| | | | | | |

| | | | | | |

Continuing Directors

| | | | | | | | | | | | | | | | | | | | |

| | Ashutosh Kulkarni (Chief Executive Officer) | |

| Background and Experience | |

| Ashutosh Kulkarni has served as our CEO since January 2022 and was elected to our board of directors in March 2022. Mr. Kulkarni previously served as our Chief Product Officer from January 2021 to January 2022.

•Prior to joining us, he served as Executive Vice President and Chief Product Officer, Enterprise Business Group, at McAfee Corp., a digital provider of cyber security services, from October 2018 until December 2020.

•Prior to joining McAfee Corp., Mr. Kulkarni served as Senior Vice President and General Manager at Akamai Technologies in the Web Performance and Web Security division and in the Web Experience division from August 2016 to October 2018 and August 2015 to August 2016, respectively.

•Prior to that, Mr. Kulkarni held various senior leadership, product management, product marketing and engineering roles at Akamai Technologies, Informatica and Sun Microsystems.

| |

| |

| |

| |

Age: 47

| | |

| | |

| |

| |

| | | | | | |

Education | | Qualifications | |

Mr. Kulkarni earned an M.S. in computer engineering from the University of Texas at Austin, an M.B.A. degree from the University of California, Berkeley and a B.E. in engineering from the University of Mumbai. | | We believe that Mr. Kulkarni is qualified to serve as a member of the Board because of the perspective he brings as our CEO, our former Chief Product Officer, and his experience as an executive in the technology industry. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Shay Banon (Chief Technology Officer) | |

| Background and Experience | |

| Shay Banon co-founded our Company and has served as a member of our board of directors since July 2012 and as our CTO since January 2022. Mr. Banon served as our CEO from May 2017 to January 2022, and as our Chairman and CEO from June 2018 to January 2022. He previously also served as our Chief Technology Officer from July 2012 to April 2017. Mr. Banon is the creator of our Elasticsearch product.

| |

| |

| |

| |

Age: 44

| | |

| | |

| |

| |

| | | | | | |

Education | | Qualifications | |

Mr. Banon holds a B.Sc. in Computer Science from Technion, Israel Institute of Technology. | | We believe that Mr. Banon is qualified to serve as a member of our board of directors because of the perspective and experience he brings as our CTO, our prior CEO and co-founder and his experience as an executive in the technology industry. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Jonathan Chadwick | |

| Background and Experience | |

| Jonathan Chadwick has served as a member of our board of directors since August 2018. Mr. Chadwick has been a private investor since April 2016.

•From November 2012 to April 2016, Mr. Chadwick served as Chief Financial Officer (“CFO”) and Executive Vice President of VMware, Inc., a virtualization and cloud infrastructure solutions company, and from August 2014 to April 2016, he also served as VMware’s Chief Operating Officer (“COO”).

•From March 2011 until November 2012, he served as the CFO of Skype Communication S.á.r.l., a voice over IP (VoIP) service, and as a corporate vice president of Microsoft Corporation after its acquisition of Skype in October 2011.

•From June 2010 until February 2011, Mr. Chadwick served as Executive Vice President and CFO of McAfee, Inc., a security software company, until its acquisition by Intel Corporation.

•From September 1997 until June 2010, Mr. Chadwick served in various executive roles at Cisco Systems, Inc., a multinational technology company (“Cisco”).

•He also currently serves on the board of directors of Confluent, Inc., a data infrastructure company, Samsara Inc., an IT company, ServiceNow, Inc., a cloud computing company, Zoom Video Communications, Inc., a provider of remote conferencing services, and various private companies. He previously served on the board of directors of Cognizant Technology Solutions Corporation, an IT business services provider, from April 2016 to December 2019, and F5 Networks, Inc., an application networking delivery company, from August 2011 until March 2019.

•He also worked for Coopers & Lybrand in various roles in the U.S. and the U.K.

| |

| |

| |

| |

Age: 56

| | |

Audit Committee (Chair)

Compensation Committee | | |

| |

| |

| | | | | | |

Education | | Qualifications | |

Mr. Chadwick qualified as a Chartered Accountant in England and holds a B.Sc. degree in Electrical and Electronic Engineering from the University of Bath, U.K. | | We believe Mr. Chadwick is qualified to serve as a member of our board of directors because of his significant financial expertise as a CFO and service on the boards of directors of various public companies. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Alison Gleeson | |

| Background and Experience | |

| Alison Gleeson has served as a member of our board of directors since January 2020. She currently also serves as a sales strategic advisor to Verkada Inc., a professional monitoring and video verification threat detection company, since August 2021, and Special Advisor and Operating Committee Member at Brighton Park Capital, an investment firm, since October 2019.

•From November 2018 to September 2019, she was a private investor.

•From January 1996 to October 2018, Ms. Gleeson was with Cisco, where she served in various roles, most recently as Senior Vice President, Americas from July 2014 to October 2018.

•Ms. Gleeson currently also serves on the board of directors of 8x8, Inc., a cloud-based provider of voice over IP products, and Zoominfo Technologies Inc., a comprehensive sales and marketing intelligence SaaS platform.

| |

| |

| |

| |

Age: 57

| | |

Compensation Committee (Chair) | | |

| |

| |

| | | | | | |

Education | | Qualifications | |

Ms. Gleeson holds a B.A. in Marketing from Michigan State University. | | We believe Ms. Gleeson is qualified to serve as a member of our board of directors because of her prior executive and go-to-market experience for a large public company. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Shelley Leibowitz | |

| Background and Experience | |

| Shelley Leibowitz has served as a member of our board of directors since October 2021. Ms. Leibowitz currently serveshas served since January 2016 as President of SL Advisory, which provides advice and insights in innovation and digital transformation, information technology portfolio and risk management, digital trust, performance metrics, and effective governance, and has served in such capacity since January 2016.governance. | |

| |

| |

| •From 2009 through 2012, Ms. Leibowitz served as Chief Information Officer for the World Bank Group. •Prior to that service, Ms. Leibowitz held Chief Information Officer positions at top-tier financial institutions, including Morgan Stanley, a global financial services firm, and Greenwich Capital Markets.Markets, a fixed income financial services firm. •She currently serves as a director of Morgan Stanley, a global financial services firm.Stanley. Previously she served as a director of Massachusetts Mutual Life Insurance Company, an insurance and financial services provider, from October 2019 to April 2021, E*Trade Financial Corporation, a financial services company, from December 2014 to October 2020, and AllianceBernstein Holding L.P., a global asset management firm, from November 2017 to June 2019. •Ms. Leibowitz also serves on the boards of directors of private companies in the cybersecurity and risk arenas. | |

| |

| |

| |

Age: 6162 | | |

Audit Committee

Nominating and Corporate Governance Committee | | |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Ms. Leibowitz holds a B.A. in Mathematics from Williams College. | | We believeThe board of directors believes that Ms. Leibowitz is qualified to serve as a member of our board of directors because of her current and prior executive and directorship experience and extensive leadership and experience in technology services, digital transformation, and information security. | |

| |

| |

| | | | | | |

| | | | | | |

Board of Directors

We have a one-tier board of directors, consisting of executive and non-executive directors. The number of executive and non-executive directors is to be determined by the board of directors.

Our one-tier board structure consists of two executive directors and seven non-executive directors. Chetan Puttagunta serves as our Chairman and Lead Independent Director. For more information regarding our board leadership structure, please see “Board of Directors and Corporate Governance—Governance | Elastic 2023 Proxy Statement 10

| | | | | | | | | | | | | | | | | | | | |

| | Chetan Puttagunta

(Chairperson and Lead Independent Director) | |

| Background and Experience | |

| Chetan Puttagunta has served as a member of our board of directors since January 2017, as our Chairperson since January 2022, and as our Lead Independent Director since June 2018. Mr. Puttagunta has served as General Partner of Benchmark Capital Partners, a venture capital firm, since July 2018. | |

| |

| |

Age: 37 | | •From October 2016 until July 2018, Mr. Puttagunta served as a General Partner of New Enterprise Associates, a venture capital firm he joined in April 2011. •Mr. Puttagunta also serves on the boards of directors of various private companies. | |

Nominating and Corporate Governance Committee (Chair)

Audit Committee | | |

| |

| |

| |

| | | | | | |

| Education | | Qualifications | |

| Mr. Puttagunta holds a B.S. in Electrical Engineering from Stanford University. | | The board of directors believes that Mr. Puttagunta is qualified to serve as a member of our board of directors because of his extensive experience in the venture capital industry and his knowledge of the technology industry. | |

| |

| |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Steven Schuurman | |

| Background and Experience | |

| Steven Schuurman co-founded our Company and has served as a member of our board of directors since July 2012 and previously served as our CEO from July 2012 to May 2017. Mr. Schuurman serves on the boards of various private companies.

| |

| |

| |

| |

Age: 47 | | |

| | |

| |

| | | | | | |

| Education | | Qualifications | |

| Mr. Schuurman holds a B.Sc. in Electrical Engineering from TH Rijswijk, now known as The Hague University of Applied Sciences. | | The board of directors believes that Mr. Schuurman is qualified to serve as a member of our board of directors because of his deep understanding of our business, operations and strategy due to his role as our co-founder and former CEO. | |

| |

| |

| | | | | | |

| | | | | | |

Board Leadership Structureof Directors and Role of Independent Chairman and the Lead Independent Director.”Corporate Governance | Elastic 2023 Proxy Statement 11

Pursuant to our articles of association, our executive and non-executive directors may be appointed for a maximum term of three years (unless such director has resigned at an earlier date). A director may be reappointed, and the three-year maximum term may be deviated from by resolution of the general meeting of shareholders upon a proposal of the board of directors.

The members of our board of directors have been appointed to staggered terms. The current terms of Ms. Marooney and Messrs. Puttagunta and Schuurman will expire at this Annual Meeting; the terms of Ms. Gleeson and Mr. Chadwick will expire at the annual general meeting of shareholders to be held in 2023; the terms of Mr. Banon and Ms. Leibowitz will expire at the annual general meeting of shareholders to be held in 2024; and the term of Mr. Kulkarni will expire at the annual general meeting of shareholders to be held in 2025. Mr. Abbasi was appointed to our board of directors to temporarily fill the vacancy resulting from Mr. Volpi’s resignation, such appointment and resignation both effective as of July 13, 2022. The term of Mr. Abbasi’s temporary appointment will expire upon the earlier of (i) the vacancy created by Mr. Volpi’s resignation being filled, which will occur if Mr. Abbasi is appointed upon conclusion of the Annual Meeting in accordance with voting proposal no. 1, (ii) the board appointing another person to temporarily fill such vacancy or (iii) the vacancy has been cancelled.

Director Independence

Under the rules of the New York Stock Exchange (“NYSE”), on which our ordinary shares are listed, independent directors must compriseconstitute a majority of a listed company’s board of directors. directors, as independence is determined by the board of directors in accordance with the NYSE rules. Under those rules, to determine that a director is independent, the board of directors must determine that the director has no material relationship with the listed company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the listed company. When assessing the materiality of a director’s relationship, if any, with the listed company, the board of directors must consider materiality from the standpoint of the director and from the standpoint of persons or organizations with which the director has an affiliation.

In addition, the rules of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees must be independent. Under the rules of the NYSE, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Compensation committee members mustmay not have a relationship with usthe listed company that is material to the director’s ability to be independent from management in connection with the duties of a compensation committee member. Additionally, auditAudit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act.

In order toTo be considered independent for purposes of Rule 10A-3, a membermembers of an audit committee of a listed company may not, other than in their capacity as a member of the audit committee, the board of directors or any other board committee, accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors has undertaken a review of the independence of each director and considered whether eachany director has a material relationship with us that could compromise theirthe director’s ability to exercise independent judgment in carrying out their responsibilities. Based uponresponsibilities on the board of directors. In its determination, the board of directors considered information requested from and provided by each director concerning their background, employment and affiliations, including family relationships and asbeneficial ownership of our shares. As a result of this review, our board of directors determined that each of Messrs. Abbasi, Auvil, Chadwick, Puttagunta, and Schuurman, and Mses. Gleeson, Leibowitz, and Marooney representing sevenare independent under the rules of the NYSE and our nine continuingcorporate governance guidelines, which incorporate the director independence standards of those rules. The independent directors and directorcomprise each of the three nominees standing for appointment at the Annual Meeting, doesall five of the non-executive directors who will serve as continuing directors after the Annual Meeting, and Mr. Chadwick, who currently serves as a non-executive director, but who is not have a relationshipstanding for re-appointment at the Annual Meeting. The board of directors further determined that would interfere with the exercisecurrent members of independent judgment in carrying out the responsibilities ofour Compensation Committee and Audit Committee, as well as Mr. Auvil, who will serve on those committees if appointed as a director and is an “independent director” as defined underat the applicable rules and regulations ofAnnual Meeting, met the SEC andadditional independence requirements for membership on the listing requirements andcommittees specified in the rules of the NYSE. In making this determination, our board of directors consideredNYSE and Rule 10A-3 under the current and prior relationships that each non-executive director has with our Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our shares by each non-executive director.Exchange Act.

In addition to the independence requirements under the NYSE rules, the Dutch Corporate Governance Code (the “DCGC”) requires a majority of the non-executive directors of our board of directors, a majority of the members of each of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance

Committee, and the Lead Independent Director to be independent. The DCGC provides for a different definition of an “independent director” that differs from the definition under the NYSE rules and assesses only assesses independence of non-executive directors. A non-executive director is considered not independent under the DCGC if the director or the director’s spouse, registered partner or life companion, foster child or relative by blood or marriage up to the second degree degree:

(i) has been an employee, managing director or executive director of the company in the five years prior to appointment, appointment;

(ii) has received personal financial compensation from us for work not in keeping with the normal course of business, business;